Do you think Congress is totally partisan? (Note to my Tea Party impaired friends, "partisan" means "prejudiced in favor of a particular cause", that is, either Democratic or Republican in this case. It does not mean, "Contrary to my current beliefs".) Partisanship has been most dramatically manifested by the Republicans voting lockstep against any Democratic proposals regardless of merit, some of which they once supported or even invented themselves! Even so, I don't think they're uniquely partisan. Because the one issue both parties agree upon is kowtowing to the super rich.

Let me define "super rich". A super rich person already has so much wealth that his lifetime material security is guaranteed. The pathologically super rich, though, become unhappy if their wealth fails to increase every moment in time. Any involuntary cost, even though it will have zero lifestyle impact, even though it might actually benefit them, is tantamount to a physical assault. This includes taxation. (Whether this arises from overly controlling parents, or not being held enough as infants, we can only speculate.) Those who benefit from the Golden Goose that lays their golden eggs, the infrastructure that makes wealth possible, need to help feed the goose. It is impossible to single handedly create wealth in a vacuum. But neither party seems to have the guts to ask these folks for sufficient revenue to protect and build our Commons. (Yes, that's capital "C" Commons. Please review the definition.)

Which brings us to the topic at hand, the fabricated myth of The Fiscal Cliff, lions, tigers and bears, oh my! (Will we ever develop immunity to irrational, baseless fears?) "The Fiscal Cliff" rolls off the tongues of pundits in every media with little explanation of what the hell it actually is or why, or even if, it is a bad thing. Personally, I think we should let "it" happen and I'll explain what "it" is in a moment. But before that, start thinking of The Fiscal Cliff instead as a snowy Fiscal Bluff over which we're about to take a fun glide on our Fiscal Sleds, ("Bluff" being an intentional double entendre). The Fiscal Cliff is an exaggerated, astoundingly nationalistic & partially manufactured distraction from vastly more serious issues such as the poisoning of everything we ingest & global climate change. issues nobody wants to deal with until it is too late. Which it probably already is. But . . .

To put it simply, our economy will tumble over the Fiscal Bluff in January, supposedly, when two job killing events will occur: higher taxes caused by the expiration of the Bush tax giveaways, and, precipitous cuts in government spending. Media and political dufuses somberly lament that this will allegedly send unemployment sky high and the markets into a ravine. You would think an asteroid is hurtling towards us. Some people perversely lust so much for this to be true that they're firing otherwise profitable employees (need I say Papa Johns?).

The first odd thing you will note about these two devilish horns is the implication that government spending creates jobs, which is true with one major exception. The exception is military spending which, although it does create jobs, only creates one-third as many as, say, building a domestic school or bridge. The second odd thing you will note is the implication that taxes create unemployment, which is false with few exceptions. These two views are incompatible. So reality must be somewhere in between.

The details are too lengthy to post here, but that's the beauty of the Internet (which arose from government programs, by the way). Do your own research and don't believe anyone, including me. So, in anticipation of this sleigh ride, what do you do with your money? Stash it in places that will protect it from any market declines but which will also participate in market gains should those occur. Yes, there are such places.

To be continued . . .

Search This Blog

Monday, December 17, 2012

Friday, October 19, 2012

MYTH: The FDIC has 99 years to pay claims

I'm not sure where this myth originated nor do I really care. But it is a myth indeed. (I suspect either anti-government zealots and/or crooks selling "better" savings vehicles.) The fact is that FDIC regulations require the FDIC to replace lost bank deposits "as soon as possible " (see 12 USC1821(f)), usually the next day.

The FDIC was formed in response to the bank failures of the Great Depression (no, not this one, the one in 1929), Prozac for the banking system so to speak. I think it was a mistake because one artifact of safety nets such as the FDIC is that those with moral weakness (aka "humans") might tend to take more risks than they would in the absence of the insurance.

For example, imagine a football game with no referees. Instead there is just Game Insurance so that whichever team loses the game actually gets to win. Both teams win! Cheating & incompetence don't matter! How hard would either team try if that were the case?? I would prefer strict rules strictly enforced, with real penalties, which is how football is conducted now. Anybody know of a Wall Street banker who has been jailed since 2008? I don't. Where are the hundreds of heads that should be rolling from AIG, Lehman, & Countrywide, to name a few? The only things that are rolling are their companies' executives . . . in cash. Win win.

But back to the topic, the FDIC is indeed an important safety net for those of us here at the bottom of the food chain. And a married couple can easily enjoy a million dollars of protection. At the same bank. Each may have an IRA and an savings account insured up to $250k per account.

Having said that, keep in mind that there is no risk-free investment or savings vehicle. Let me say that another way. There is no risk-free investment or savings vehicle. (Do a google search for "financial risk" to review the different types of risk.) This is important enough to say a third way: There is no risk-free investment or savings vehicle. Here's why.

Although CDs and bank accounts are FDIC insured, they guarantee that you'll be subject to inflation certainty. Not inflation risk ("risk" is when you're unsure whether or not an event will occur.), inflation certainty because inflation will certainly exceed the returns your bank can offer.

So ultimately, the types of financial risk you need to minimize depend on what order you rank the four main financial priorities for a portfolio:

The FDIC was formed in response to the bank failures of the Great Depression (no, not this one, the one in 1929), Prozac for the banking system so to speak. I think it was a mistake because one artifact of safety nets such as the FDIC is that those with moral weakness (aka "humans") might tend to take more risks than they would in the absence of the insurance.

For example, imagine a football game with no referees. Instead there is just Game Insurance so that whichever team loses the game actually gets to win. Both teams win! Cheating & incompetence don't matter! How hard would either team try if that were the case?? I would prefer strict rules strictly enforced, with real penalties, which is how football is conducted now. Anybody know of a Wall Street banker who has been jailed since 2008? I don't. Where are the hundreds of heads that should be rolling from AIG, Lehman, & Countrywide, to name a few? The only things that are rolling are their companies' executives . . . in cash. Win win.

But back to the topic, the FDIC is indeed an important safety net for those of us here at the bottom of the food chain. And a married couple can easily enjoy a million dollars of protection. At the same bank. Each may have an IRA and an savings account insured up to $250k per account.

Having said that, keep in mind that there is no risk-free investment or savings vehicle. Let me say that another way. There is no risk-free investment or savings vehicle. (Do a google search for "financial risk" to review the different types of risk.) This is important enough to say a third way: There is no risk-free investment or savings vehicle. Here's why.

Although CDs and bank accounts are FDIC insured, they guarantee that you'll be subject to inflation certainty. Not inflation risk ("risk" is when you're unsure whether or not an event will occur.), inflation certainty because inflation will certainly exceed the returns your bank can offer.

So ultimately, the types of financial risk you need to minimize depend on what order you rank the four main financial priorities for a portfolio:

- Preservation

- Income

- Liquidity

- Growth

Sunday, September 2, 2012

MYTH: The Best Place Is a Money Milkshake!

The most frequent question posed to me by clients, friends & new contacts is this: "Where's the best place to put my money?" I'll get to the presumptions behind this question in a minute. But it cannot be honestly answered without more information.

I usually say, "Well, it depends on what you want, what your plans are, your current asset level, when you want to retire, your pre & post-retirement budget, how long you expect to live, your debt level, your rate of return history and expectations, your risk tolerance, your health, your wishes for your family or charities . . " and so on. Sometimes though, if I'm feeling flippant, I'll say something like "It all depends on what you want. If you want a money milkshake, the best place for your money is in a blender with vanilla ice cream and blueberries." I'm sure, more often than not, that feels evasive, like I'm dodging the issue.

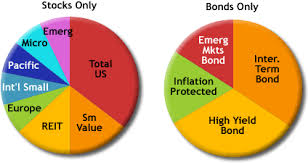

So what are people thinking when they pose that question? I suspect most have in the backs of their minds that authoritative but fickle pie chart that shows up on their brokerage/retirement statements. You know, similar to these:

Looking backwards, they are painfully aware that if only they had adjusted those pieces of the pie, they would have made a ton of money rather than losing. Or, if they hadn't been so conservative, they would have at least kept up with inflation. They blame themselves for responding- or not responding -to Wall Street's siren call. "Now is always a good time to invest!" as TV's financial guru (not) Cramer screams. But they shouldn't blame themselves. Over the 20 years ending 12/31/2010, average equity fund investors earned 3.83%/yr. The S&P500 index earned 9.14%! The problem is chasing returns, buying high and selling low, and incurring too many expenses. (And then there's the issue of the shrinking number of fund managers who actually beat the unmanaged indexes. As financial data becomes more and more accessible, only about 15% of managers beat the indexes to which their styles are compared.)

But why settle for even the S&P500 returns? Below is a rather complicated graph but it's very important. It shows RISK (defined as how wildly your account balance swings up and down over time) and RETURN (the average annual return over the 10 year period shown) for the S&P500 vs. Vanguard. Note how much better Vanguard's unmanaged, low cost index portfolios outperform the S&P500 at large. Even so, can we rely on the past to predict the future?

So embedded in the question, "Where is the best place to put my money." is this one: "Where can I get the highest returns without any risk?" What is it perhaps more important to ask? Because the key is asking the right questions. In addition to those posed in my second paragraph, these additional money questions are essential:

Best Always,

Gary

I usually say, "Well, it depends on what you want, what your plans are, your current asset level, when you want to retire, your pre & post-retirement budget, how long you expect to live, your debt level, your rate of return history and expectations, your risk tolerance, your health, your wishes for your family or charities . . " and so on. Sometimes though, if I'm feeling flippant, I'll say something like "It all depends on what you want. If you want a money milkshake, the best place for your money is in a blender with vanilla ice cream and blueberries." I'm sure, more often than not, that feels evasive, like I'm dodging the issue.

So what are people thinking when they pose that question? I suspect most have in the backs of their minds that authoritative but fickle pie chart that shows up on their brokerage/retirement statements. You know, similar to these:

Looking backwards, they are painfully aware that if only they had adjusted those pieces of the pie, they would have made a ton of money rather than losing. Or, if they hadn't been so conservative, they would have at least kept up with inflation. They blame themselves for responding- or not responding -to Wall Street's siren call. "Now is always a good time to invest!" as TV's financial guru (not) Cramer screams. But they shouldn't blame themselves. Over the 20 years ending 12/31/2010, average equity fund investors earned 3.83%/yr. The S&P500 index earned 9.14%! The problem is chasing returns, buying high and selling low, and incurring too many expenses. (And then there's the issue of the shrinking number of fund managers who actually beat the unmanaged indexes. As financial data becomes more and more accessible, only about 15% of managers beat the indexes to which their styles are compared.)

But why settle for even the S&P500 returns? Below is a rather complicated graph but it's very important. It shows RISK (defined as how wildly your account balance swings up and down over time) and RETURN (the average annual return over the 10 year period shown) for the S&P500 vs. Vanguard. Note how much better Vanguard's unmanaged, low cost index portfolios outperform the S&P500 at large. Even so, can we rely on the past to predict the future?

So embedded in the question, "Where is the best place to put my money." is this one: "Where can I get the highest returns without any risk?" What is it perhaps more important to ask? Because the key is asking the right questions. In addition to those posed in my second paragraph, these additional money questions are essential:

- How can I minimize my costs? How can I get my money's worth for the fees I'm paying?

- How can I eliminate risk without taking a bath on poor returns?

- How should I best hold my invested assets (in qualified retirement accounts, real estate, hybrid products, trusts?) to be sure my plans are fulfilled?

- What trends may make historical performance a permanent thing of the past? What is reasonable to expect in the rapidly changing future?

Best Always,

Gary

Saturday, August 11, 2012

The First Thing They Teach Lifeguards

I just returned from a two-day conference with my field marketing organization Wealth Financial Group, based in Chicago. Beautiful city!

Our keynote speaker was author & consultant Frank Maselli, a dynamic, animated, hilarious, brilliant man. Frank likened us financial advisers to lifeguards, trying to convince potential drowning victims to climb into the lifeboat while there is still room. He asked us, "What is the first thing a lifeguard has to learn? To keep from being pulled under by the person you're trying to rescue!".

So true. And it highlighted the stunning frustration most of us non-Wall Street advisers feel as we holler, "Get in the boat! Get in the boat!". The general public has been splashed, dunked, slapped and- in some cases -actually drowned by Wall Street while Wall Streeters accumulate record, massive wealth.

As Nobel prize winning economist Joseph Stiglitz has stated, the economy is broken when financial rewards are disconnected from public benefit. That is, you should not make a lot of money unless you've provided a lot of benefit.

I get paid very well for what I do. Mine is a complicated, rapidly changing, essential business. I put my heart and soul into it and have for over 30 years. It is my professional mission to dispel the Wall Street myth that you have to lose money to make money. I can't believe anyone still buys that shell game. The lifeboat analogy is right on because- as I pointed out in my last blog post -the options for reducing financial risk keep shrinking in number and in quality. The lifeboats are filling up. And I am focusing on swimmers who are close by and ready to climb in.

Our keynote speaker was author & consultant Frank Maselli, a dynamic, animated, hilarious, brilliant man. Frank likened us financial advisers to lifeguards, trying to convince potential drowning victims to climb into the lifeboat while there is still room. He asked us, "What is the first thing a lifeguard has to learn? To keep from being pulled under by the person you're trying to rescue!".

So true. And it highlighted the stunning frustration most of us non-Wall Street advisers feel as we holler, "Get in the boat! Get in the boat!". The general public has been splashed, dunked, slapped and- in some cases -actually drowned by Wall Street while Wall Streeters accumulate record, massive wealth.

As Nobel prize winning economist Joseph Stiglitz has stated, the economy is broken when financial rewards are disconnected from public benefit. That is, you should not make a lot of money unless you've provided a lot of benefit.

I get paid very well for what I do. Mine is a complicated, rapidly changing, essential business. I put my heart and soul into it and have for over 30 years. It is my professional mission to dispel the Wall Street myth that you have to lose money to make money. I can't believe anyone still buys that shell game. The lifeboat analogy is right on because- as I pointed out in my last blog post -the options for reducing financial risk keep shrinking in number and in quality. The lifeboats are filling up. And I am focusing on swimmers who are close by and ready to climb in.

Tuesday, July 31, 2012

MYTH: I can always buy Long Term Care insurance later

I know it must be irritating to you. But I won't stop doing it. That is, regaling you of the steadily shrinking options for reducing your financial risks. The quantity and quality of techniques to protect yourself and your money are in an entropic spiral.

For example, I've mass emailed ad nauseum about the financial safe haven of annuities (which, not surprisingly, the Wall Street owned corporate press continue to trash). My best company, Aviva, just reduced their minimum interest rate to 1%, making it not much better than the average CD (if it weren't for the additional benefits of tax deferral and guaranteed income).

Long Term Care risk management strategies have also been dragged onto the chopping block virtually every month. Several big names have pulled out of the market altogether, such as Prudential and MetLife. Others have discontinued lifetime benefits and what are called "limited pay" premium schedules. Used to be that you could pay larger fixed premiums for 10-20 years thereby eliminating the risk of future rate increases. All have increased their rates on new applicants and existing policyholders alike. My own premiums have doubled in the last 10 years, but are still 1/2 the cost of a similar policy these days. Pays to buy it early!

But sadly, the best buy in Oregon for healthy nonsmokers, United of Omaha, is discontinuing lifetime benefits, group plans, and limited pay options effective with applications signed by tomorrow, August 1. They just told me this today! They also implemented a healthy rate increase a month ago.

What does all this mean? It means that long term care is a serious risk, so serious that it has the insurance companies running scared. The good news is, if properly structured, sufficient protection is still very affordable. With Federal deductibility of premiums and 15% Oregon tax credit, this type of insurance is heavily favored by not only the tax code but several other State and Federal provisions, such as the Partnership Program.

For example, I've mass emailed ad nauseum about the financial safe haven of annuities (which, not surprisingly, the Wall Street owned corporate press continue to trash). My best company, Aviva, just reduced their minimum interest rate to 1%, making it not much better than the average CD (if it weren't for the additional benefits of tax deferral and guaranteed income).

Long Term Care risk management strategies have also been dragged onto the chopping block virtually every month. Several big names have pulled out of the market altogether, such as Prudential and MetLife. Others have discontinued lifetime benefits and what are called "limited pay" premium schedules. Used to be that you could pay larger fixed premiums for 10-20 years thereby eliminating the risk of future rate increases. All have increased their rates on new applicants and existing policyholders alike. My own premiums have doubled in the last 10 years, but are still 1/2 the cost of a similar policy these days. Pays to buy it early!

But sadly, the best buy in Oregon for healthy nonsmokers, United of Omaha, is discontinuing lifetime benefits, group plans, and limited pay options effective with applications signed by tomorrow, August 1. They just told me this today! They also implemented a healthy rate increase a month ago.

What does all this mean? It means that long term care is a serious risk, so serious that it has the insurance companies running scared. The good news is, if properly structured, sufficient protection is still very affordable. With Federal deductibility of premiums and 15% Oregon tax credit, this type of insurance is heavily favored by not only the tax code but several other State and Federal provisions, such as the Partnership Program.

Monday, July 9, 2012

MYTH: Financial rewards are the best motivation

I must give credit for this post to Paul Begala, political writer for Newsweek. In the June 25th issue he passed on an anecdote which, whether true or not, epitomizes a major destructive attitude, a cultural virus in our country. I quote it directly:

I have a wealthy friend who lives in a wealthy neighborhood. One day he was in his front yard, chatting with his next-door neighbor, a Republican, who asked him why he's a Democrat. My friend said he'd grown up poor but had gotten a good public education, worked his tail off, and made it. Then he pointed to the gardener across the street. "Don't you want that gardener's son to live the same American Dream we have?" His neighbor shot him down, sniffing, "That gardener's son will be my son's gardener".

This is entitlement thinking- and parenting -at its worst. I like Warren Buffet's philosophy that you want to give your children enough so they can do anything, but not too much so they don't have to do anything. The guy in the story has embodied the mentalities that we came here to this continent to escape; nepotism, meritless accumulation of wealth and power, repression of the virtue, hard work and intelligence of our fellow citizens. What if his son turns out to be a lazy jerk? And the gardener's son a brilliant inventor who, for lack of basic education fails to blossom? We, as a society, lose. The rich son loses. The gardener's son loses. Personally, I expected my son to make his own mistakes, take some hard knocks, and learn to rely not only on his own brains and initiative but also to seek out help and partnerships from others, while pursuing work that he enjoys and is good at. After an excellent education in our public schools and universities, he makes a great living and loves his work. He has become a healthy adult, highly valued in our economy. The question is not what we get in this life, but what we become. I know I've said that many times. It's worthy of repetition.

People who are insecure & afraid can become greedy and lose their compassion for others. Another favorite quote: The highest expression of human intelligence is kindness. (And I don't mean shallow courtesies.) Although our Republican Congress is not the exclusive domain of this sickness, they dominate the field. Rather than skillful statesmen ( remember Mark Hatfield?) they have become small-minded, mean-spirited, irrational sycophants, creating a death spiral to the bottom of dysfunction by institutionalizing the "virtue" of aggressively self-imposed stupidity. As a result, the self-destructive culture they have created, after a 30-yr. concerted effort, is harming themselves more than the issues they fear (gays, taxes, government regulation, dark-skinned people. non-Christians, equal opportunity etc.) In fact, their fears have been baseless all along. They have met the enemy in the mirror.

I have a wealthy friend who lives in a wealthy neighborhood. One day he was in his front yard, chatting with his next-door neighbor, a Republican, who asked him why he's a Democrat. My friend said he'd grown up poor but had gotten a good public education, worked his tail off, and made it. Then he pointed to the gardener across the street. "Don't you want that gardener's son to live the same American Dream we have?" His neighbor shot him down, sniffing, "That gardener's son will be my son's gardener".

This is entitlement thinking- and parenting -at its worst. I like Warren Buffet's philosophy that you want to give your children enough so they can do anything, but not too much so they don't have to do anything. The guy in the story has embodied the mentalities that we came here to this continent to escape; nepotism, meritless accumulation of wealth and power, repression of the virtue, hard work and intelligence of our fellow citizens. What if his son turns out to be a lazy jerk? And the gardener's son a brilliant inventor who, for lack of basic education fails to blossom? We, as a society, lose. The rich son loses. The gardener's son loses. Personally, I expected my son to make his own mistakes, take some hard knocks, and learn to rely not only on his own brains and initiative but also to seek out help and partnerships from others, while pursuing work that he enjoys and is good at. After an excellent education in our public schools and universities, he makes a great living and loves his work. He has become a healthy adult, highly valued in our economy. The question is not what we get in this life, but what we become. I know I've said that many times. It's worthy of repetition.

People who are insecure & afraid can become greedy and lose their compassion for others. Another favorite quote: The highest expression of human intelligence is kindness. (And I don't mean shallow courtesies.) Although our Republican Congress is not the exclusive domain of this sickness, they dominate the field. Rather than skillful statesmen ( remember Mark Hatfield?) they have become small-minded, mean-spirited, irrational sycophants, creating a death spiral to the bottom of dysfunction by institutionalizing the "virtue" of aggressively self-imposed stupidity. As a result, the self-destructive culture they have created, after a 30-yr. concerted effort, is harming themselves more than the issues they fear (gays, taxes, government regulation, dark-skinned people. non-Christians, equal opportunity etc.) In fact, their fears have been baseless all along. They have met the enemy in the mirror.

Tuesday, June 19, 2012

Myth: You think you know . . .

In a great article given to me by my Mother, Linfield College economics professor Eric Schuck claims, "What you think you know is wrong." The article appears in The Oregonian at http://www.oregonlive.com/opinion/index.ssf/2012/06/debunking_economic_myths_or_th.html The online title is "Debunking economic myths [which is dear to my heart], or the trouble with what you think you know"

I will summarize and gently editorialize his three myths:

Myth #1. Firms (companies) are job creators-

Giving special deference to firms as "job creators" simply is not an accurate assessment of their mission and role in society. They make profits, not jobs. Professor Schuck goes on to point out that to an economist jobs generally aren't a benefit, they're a cost of profit-making. Under our current legal structure, the primary purpose of a corporation is to make money for its owners. If they can do it without employing anyone, then they must. Such is the psychosis of the corporate model. I highly recommend the documentary, The Corporation.

So whose legal mission is it to create jobs? That would be an obligation of the federal government under the Employment Acts of 1946 and 1978, he points out. And it has largely failed in that mission, having lost 160,000 public sector jobs this year alone. Because of myth #2.

Myth #2. Governments should work by the same budgetary rules as families.

There are two sides to this- revenue and expenditures -but I disagree that this is a myth for both sides; when times are tough for a family it makes sense to increase revenue if at all possible, just like governments must [selectively] raise taxes in a recession. And some "deficit" spending is necessary for a family too such as taking out education loans for retraining or getting a new outfit to dress for success in job interviews. But Professor Schuck is right on that the role of government is to stabilize the economy. Which means preserving jobs whenever possible.

Myth #3. Federal deficits are the scariest problem the economy faces.

This section is so good I have to include the whole thing: [Federal deficits are] not, and here's why: Current interest rates on federally issued bonds are running at about 1.5 percent. Current inflation rates are right around 2 percent. Adjusting for inflation, the real interest rates on public debt is "less than zero." Effectively, people buying U.S. Treasury bonds are paying the government to borrow money from them. If there was ever a time to run a deficit to offset reductions in spending at the state and local level to stop job losses, this is it. Better still would be to use those negative real interest rates to finance infrastructure investments that both create demand and improve productive capacity. There are worse things in this world than using debt to pay for much-needed roads, cops and schools, especially when the short-run cost of that debt is pretty much zero. Debt and deficits are long-run problems; unemployment is a short-run problem. Fix today's problems first. By increasing, not decreasing, government spending.

I will summarize and gently editorialize his three myths:

Myth #1. Firms (companies) are job creators-

Giving special deference to firms as "job creators" simply is not an accurate assessment of their mission and role in society. They make profits, not jobs. Professor Schuck goes on to point out that to an economist jobs generally aren't a benefit, they're a cost of profit-making. Under our current legal structure, the primary purpose of a corporation is to make money for its owners. If they can do it without employing anyone, then they must. Such is the psychosis of the corporate model. I highly recommend the documentary, The Corporation.

So whose legal mission is it to create jobs? That would be an obligation of the federal government under the Employment Acts of 1946 and 1978, he points out. And it has largely failed in that mission, having lost 160,000 public sector jobs this year alone. Because of myth #2.

Myth #2. Governments should work by the same budgetary rules as families.

There are two sides to this- revenue and expenditures -but I disagree that this is a myth for both sides; when times are tough for a family it makes sense to increase revenue if at all possible, just like governments must [selectively] raise taxes in a recession. And some "deficit" spending is necessary for a family too such as taking out education loans for retraining or getting a new outfit to dress for success in job interviews. But Professor Schuck is right on that the role of government is to stabilize the economy. Which means preserving jobs whenever possible.

Myth #3. Federal deficits are the scariest problem the economy faces.

This section is so good I have to include the whole thing: [Federal deficits are] not, and here's why: Current interest rates on federally issued bonds are running at about 1.5 percent. Current inflation rates are right around 2 percent. Adjusting for inflation, the real interest rates on public debt is "less than zero." Effectively, people buying U.S. Treasury bonds are paying the government to borrow money from them. If there was ever a time to run a deficit to offset reductions in spending at the state and local level to stop job losses, this is it. Better still would be to use those negative real interest rates to finance infrastructure investments that both create demand and improve productive capacity. There are worse things in this world than using debt to pay for much-needed roads, cops and schools, especially when the short-run cost of that debt is pretty much zero. Debt and deficits are long-run problems; unemployment is a short-run problem. Fix today's problems first. By increasing, not decreasing, government spending.

Friday, May 11, 2012

Ten Predictions for 2012

I've learned to severely limit my clairvoyant claims; even with what seems to be the perfect collection of data it only takes one tiny detail to derail an entire prediction. It's like winning a Tesla sports car . . . with no key.

So I'm borrowing these Ten Key Predictions from Neuberger Berman, courtesy of AdvisorOne*, so that if they don't pan out I can simply return them. I do agree with all ten, in principle and except as noted.

#10- Sector rotation continues to be pivotal- They see "attractive" returns in energy, information technology, staples (like sugar, rice, etc. not paper staples) & health care. Which means higher than normal inflation in those areas too.

#9- High geopolitical tensions- Although somewhat stable, there seems to be no place for security seekers. China may not be the economic engine we imagined.

#8- Income oriented assets will be "an attractive source of income" Neuberger likes master limited partnerships. But for you and me, equity indexed annuities with income guarantees are safer. Aviva is attempting to pull their killer annuity from the national market but Oregon won't let them do it quite yet. Please take the time to let me explain this product to you. It's going away soon!

#7- Favor high-quality equities if you simply can't resist the stock market. In the short term I disagree with this in principle because I see little to support the current market bubble.

#6- Global Monetary Easing may make commodities and emerging markets attractive. Key word is "may". I'm still not sure what effect the $600 trillion in outstanding CDOs will have if and when they come home to roost.

#5- China will experience a soft landing. What? China's not going gangbusters anymore? No, it isn't because no one can afford to buy their stuff.

#4- European Debt crisis will reach a tipping point. Failure to reach any workable solutions means the EU will by default (linguistically not financially) select "none of the above". The tentacles from that mess reach around the world. And the possible effect on us is exacerbated by the USA's shadow inventory of foreclosures.

#3- USA avoids double dip recession. I don't know. The really smart guys are saying 1.5-2% "growth" in our economy. But I just don't trust the employment and housing data coming out. Sure more people are getting jobs but are they real jobs? Family wage jobs? Full time with benefits jobs? In most cases, no. So who is going to buy all the stuff?

#2- Obama will win a second term. However you feel about this, the stats show that with an approval rating at or above 48% and unemployment below 7.4% Obama should win. And then there's the embarrassing inability of the Republicans to come up with a viable candidate. Neuberger points out that Obama's successes outweigh anything else (e.g., nine straight quarters of economic growth, 22 consecutive months of private sector job gains, the death of Osama bin Laden, Libya)

#1- Prominent Politics: significant in Europe, sound and fury here. Neuberger is far more optimistic than I that the EU members will come up with viable solutions to their fiscal ailments. And stateside it will be impossible to guess whether Congress will finally accomplish meaningful budget and tax reform. It appears many of the Congressional crazies will lose their seats this round. None too soon.

Best Always,

Gary

*http://www.advisorone.com/2012/02/27/10-key-predictions-for-markets-election-in-2012-ne?utm_source=dailywire22712&utm_medium=enewsletter&utm_campaign=dailywire&page=2

So I'm borrowing these Ten Key Predictions from Neuberger Berman, courtesy of AdvisorOne*, so that if they don't pan out I can simply return them. I do agree with all ten, in principle and except as noted.

#10- Sector rotation continues to be pivotal- They see "attractive" returns in energy, information technology, staples (like sugar, rice, etc. not paper staples) & health care. Which means higher than normal inflation in those areas too.

#9- High geopolitical tensions- Although somewhat stable, there seems to be no place for security seekers. China may not be the economic engine we imagined.

#8- Income oriented assets will be "an attractive source of income" Neuberger likes master limited partnerships. But for you and me, equity indexed annuities with income guarantees are safer. Aviva is attempting to pull their killer annuity from the national market but Oregon won't let them do it quite yet. Please take the time to let me explain this product to you. It's going away soon!

#7- Favor high-quality equities if you simply can't resist the stock market. In the short term I disagree with this in principle because I see little to support the current market bubble.

#6- Global Monetary Easing may make commodities and emerging markets attractive. Key word is "may". I'm still not sure what effect the $600 trillion in outstanding CDOs will have if and when they come home to roost.

#5- China will experience a soft landing. What? China's not going gangbusters anymore? No, it isn't because no one can afford to buy their stuff.

#4- European Debt crisis will reach a tipping point. Failure to reach any workable solutions means the EU will by default (linguistically not financially) select "none of the above". The tentacles from that mess reach around the world. And the possible effect on us is exacerbated by the USA's shadow inventory of foreclosures.

#3- USA avoids double dip recession. I don't know. The really smart guys are saying 1.5-2% "growth" in our economy. But I just don't trust the employment and housing data coming out. Sure more people are getting jobs but are they real jobs? Family wage jobs? Full time with benefits jobs? In most cases, no. So who is going to buy all the stuff?

#2- Obama will win a second term. However you feel about this, the stats show that with an approval rating at or above 48% and unemployment below 7.4% Obama should win. And then there's the embarrassing inability of the Republicans to come up with a viable candidate. Neuberger points out that Obama's successes outweigh anything else (e.g., nine straight quarters of economic growth, 22 consecutive months of private sector job gains, the death of Osama bin Laden, Libya)

#1- Prominent Politics: significant in Europe, sound and fury here. Neuberger is far more optimistic than I that the EU members will come up with viable solutions to their fiscal ailments. And stateside it will be impossible to guess whether Congress will finally accomplish meaningful budget and tax reform. It appears many of the Congressional crazies will lose their seats this round. None too soon.

Best Always,

Gary

*http://www.advisorone.com/2012/02/27/10-key-predictions-for-markets-election-in-2012-ne?utm_source=dailywire22712&utm_medium=enewsletter&utm_campaign=dailywire&page=2

Tuesday, March 6, 2012

IRS's "Dirty Dozen Tax Scams for 2012"

Tax time is an extremely emotion-laden month, whether you get a refund or a bill. Emotionality and rationality tend to be mutually exclusive, don't they? As a result, we risk becoming easy fodder for bad ideas and the scam artists who promote them. To Preserve your Wealth, avoiding mistakes is more important than finding the next hot investment.

IRS helpfully publishes their annual Dirty Dozen scam list which I will summarize for you below. If you have more time, the link is well worth exploring. Here they are:

IRS helpfully publishes their annual Dirty Dozen scam list which I will summarize for you below. If you have more time, the link is well worth exploring. Here they are:

- Identity Theft- This is one good reason to file as early as possible. Gary. It is very easy for a thief to file a false return with made-up W-2s & 1099s claiming income tax withholding that never happened. If you've already filed, IRS will notify you that a 2nd return has been filed before issuing another refund.

- Phishing- For you linguists, according to Wikipedia, "phishing" probably originated with "phreaking" which involved various tricks to steal free phone calls ("free" + "phone" = "phreak". I would have said, "phrone"), including using Cap'n Crunch whistles. Phishing scammers will bait you with a phony email that appears to have come from your bank or some official agency, asking you to confirm your social security number or other private info. Neither IRS nor banks do this by email! By the way, when you're done reading this, please send me all your passwords and PINs.

- Tax Preparer Fraud- Most preparers are honest and competent. The main danger sign is if the preparer fails to sign your return and/or doesn't have a Preparer Tax ID number on the return. Both are now required in 2012. And never consent to share any of your refund with the preparer. Finally, as a planner and not a critic, tax return preparers want to be your hero this year by maximizing your refund or minimizing your tax. But often this results in higher total taxes over your lifetime. For example, Traditional IRA contributions may be inappropriate if you expect to be in higher tax brackets in coming years (that is, all of us). Have an experienced long-term planner (uh, ahem, like me) do some projections for you.

- Hiding Income Offshore- This only works if you are in the Fortune 500 with Wall Street law firms on retainer. It does not work for real people. One website estimates there are over 36,000 corporations registered in the Cayman Islands alone. That's one & a half customers per corporation. Wow, now that's customer service.

- "Free Money" from IRS or Social Security scams- Happening more frequently in small church congregations of low income or elderly folks, the first clue here should be, "Why is this person talking about this in my church?" The scammers file false returns for a large fee, the refund arrives, and then later so does the audit letter. As far as I'm concerned, these are the lowest scumbags on the totem pole.

- False income and Expenses- You're thinking, hey wait a minute, why would I file extra income?? To get refundable credits such as the EITC or the American Opportunity Tax Credit.

- False Form 1099 Refund Claims- If you didn't get the 1099 yourself, don't let anyone make one up for you. And certainly don't let them use your info. to file a return for others.

- Frivolous Arguments- Here's a list: http://www.irs.gov/taxpros/article/0,,id=159853,00.html If you recognize any of them in a pitch made to you by a "tax expert", run in the opposite direction.

- Falsely Claiming Zero Wages- Again, for a hefty fee, scammers will indeed get you a refund. Consider it a temporary loan with a $5000 penalty.

- Abuse of Charitable Organizations and Deductions- self evident.

- Disguised Corporate Ownership- Again. And again. This only works if you are a huge multinational corporation, enjoying special tax laws you wrote yourself. (IRS never pays attention to the tax laws I write for them.) If someone says little ol' you can do the same thing, same strategy: run in the opposite direction.

- Misuse of Trusts- If it has not at least been reviewed by a local attorney that you know and trust, the trust probably will not deliver on the scammer's promise.

Sunday, February 5, 2012

Myth: "Jobs Creation" will turn the economy around.

Sorry fellow Progressives, Liberals & Democrats. The sad truth is, Job Creation is a corporate shell game unwittingly adopted by many of us, designed to perpetuate the Conservative Nanny State. Job creation sounds really nice, is politically expedient, but unfortunately is just another iteration of the thoroughly debunked "trickle down" economic theory. Feel like you're getting pissed on? That's trickle down economics happening to you.

But here's how the argument goes:

1. Lower taxes on people with gobs of money.

2. They will suddenly burst into a fever pitch of hiring many many workers to make or do new stuff.

3. Those new workers will pay new taxes.

4. Which will pay for the revenue gap created by lowering taxes on people with gobs of money.

This is trickle down, voodoo, supply side economics at its worst. It has never ever worked! Ever! And the best example is the Bush tax cuts. Between 2001 & 2007 (the Bush years, remember?) the top 400 income recipients saw their after tax income skyrocket 476%. During the same period, median family income soared, well . . . zero %. The economy shed millions of jobs & trillions of dollars in wealth. What happened?

1. The people (which includes multi-national corporations, according to our "Supreme" court) with gobs of money kept almost five times as much of it, sheltering it in offshore accounts, trusts & other tax-avoidance schemes. They are no happier than before. (The corporations, of course, feel absolutely nothing even though they are people.)

2. Rather than creating jobs, they squeezed down existing wages & benefits using the threat of unemployment as leverage.

3. People who actually work for a living saw their real income shrink or stay flat, or

4. They lost their jobs, their asses & their homes. They are much less happy than before.

5. Thereby decreasing demand for goods, stifling economic growth & decreasing tax receipts.

6. Go to #1.

Henry Ford recognized that production- or supply -does not create demand, or jobs. Purchasing power creates demand, which increases prices, production and economic growth. So he paid his employees much higher wages than his competitors because he wanted his employees to be able to afford his cars! You know the rest of the story.

Here's the key issue: do we want a country that rewards hard work, intelligence, creativity and teamwork? Or do we want a country, like we have now, that rewards being rewarded? Seriously. The argument against taxing the wealthy is that it would be "punishing success". Oh spare me. Inheriting $50 mil. is "success"? Cashing in $100 mil. in stock options is "success"? Does anyone really believe Mitt Romney "earned" $20.9 mil. last year? What value did he create in return? Would he have "worked" any less hard for $10 mil.? In truth, virtually all of the $20.9 mil. was passive income that would have come in even if both he and his wife had been in comas. That's how valuable they were in the marketplace of labor. What we are really rewarding is narcissism, plain and simple.

The rich in character, like Bill Gates and Warren Buffet, recognize that their massive wealth would have been impossible without public resources. They recognize their obligation to the system which enabled their vast wealth. Too bad this enlightened view isn't more contagious.

But here's how the argument goes:

1. Lower taxes on people with gobs of money.

2. They will suddenly burst into a fever pitch of hiring many many workers to make or do new stuff.

3. Those new workers will pay new taxes.

4. Which will pay for the revenue gap created by lowering taxes on people with gobs of money.

This is trickle down, voodoo, supply side economics at its worst. It has never ever worked! Ever! And the best example is the Bush tax cuts. Between 2001 & 2007 (the Bush years, remember?) the top 400 income recipients saw their after tax income skyrocket 476%. During the same period, median family income soared, well . . . zero %. The economy shed millions of jobs & trillions of dollars in wealth. What happened?

1. The people (which includes multi-national corporations, according to our "Supreme" court) with gobs of money kept almost five times as much of it, sheltering it in offshore accounts, trusts & other tax-avoidance schemes. They are no happier than before. (The corporations, of course, feel absolutely nothing even though they are people.)

2. Rather than creating jobs, they squeezed down existing wages & benefits using the threat of unemployment as leverage.

3. People who actually work for a living saw their real income shrink or stay flat, or

4. They lost their jobs, their asses & their homes. They are much less happy than before.

5. Thereby decreasing demand for goods, stifling economic growth & decreasing tax receipts.

6. Go to #1.

Henry Ford recognized that production- or supply -does not create demand, or jobs. Purchasing power creates demand, which increases prices, production and economic growth. So he paid his employees much higher wages than his competitors because he wanted his employees to be able to afford his cars! You know the rest of the story.

Here's the key issue: do we want a country that rewards hard work, intelligence, creativity and teamwork? Or do we want a country, like we have now, that rewards being rewarded? Seriously. The argument against taxing the wealthy is that it would be "punishing success". Oh spare me. Inheriting $50 mil. is "success"? Cashing in $100 mil. in stock options is "success"? Does anyone really believe Mitt Romney "earned" $20.9 mil. last year? What value did he create in return? Would he have "worked" any less hard for $10 mil.? In truth, virtually all of the $20.9 mil. was passive income that would have come in even if both he and his wife had been in comas. That's how valuable they were in the marketplace of labor. What we are really rewarding is narcissism, plain and simple.

The rich in character, like Bill Gates and Warren Buffet, recognize that their massive wealth would have been impossible without public resources. They recognize their obligation to the system which enabled their vast wealth. Too bad this enlightened view isn't more contagious.

The Evil of Annuities.

The financial- and not so financial -media just love protecting their readers from . . . look out! Be careful! Oh no! ANNUITIES!! Be very afraid! Every article I've read (and I don't use absolutes lightly) recommending against annuities commits one or more of these errors:

If you want the facts, call or email for my free DVD, "The Reinventing Savings Program". Or, watch it now online at Reinventing Savings

- Invalid comparisons. For example, saying annuities have "high fees" without describing to which kind of annuity they refer or to which alternative they are comparing. Variable annuities indeed have high fees, as much as 3-4%, even when you are losing money, compared to virtually every other investment alternative outside of hedge funds! Variable annuities are market-based and can lose money. Fixed and Indexed annuities do not, are not, and cannot. Some have no fees.

- Outright false or outdated information. For example, the most common claim is "Your money is tied up for ten years. Or longer!" Well guess what. In exchange for principal protection and minimum rates that are 3-4 times higher than CD rates, the annuity company needs some built in stability in return. Plus, your money really isn't "tied up". Virtually all annuities provide annual liquidity of 10% or greater. And with all the annuities I offer, penalties decline and vanish no later than the 10th year, or altogether in the case of death, terminal illness, or need for long term care. The point is, annuities are for your long term safe money!

- Focusing on the irrelevant. For example, "annuity salesmen earn huge commissions!" Even if that were true (it's not) so what? Annuity commissions are less than those you pay for houses, cars, prescriptions, electronics, and a whole slew of other things you buy. Annuities are complex and always changing, the market is very competitive, and- because of the media bias about them -it is difficult to educate a paranoid public about them. The relevant question is, "Does this particular annuity accomplish your financial goals better than any other alternative?" That is my sole focus when I select an annuity product. The answer is very often, "Yes".

If you want the facts, call or email for my free DVD, "The Reinventing Savings Program". Or, watch it now online at Reinventing Savings

Wednesday, January 11, 2012

Avoiding Fraud in 2012

My favorite financial e-newsletter, Advisor One had an article last month about the rise in "Baby Boomer Investment Scams". The New Year seems like a good time to forward this to you and add a few things myself as well (Surprise! I have an opinion!).

In a hissy fit of exaggeration, though, AdvisorOne passes along the inane idea that there is a "nationwide surge" in investment fraud, citing 1,241 regulatory actions in 2010 "more than double the 506 cases in 2009". The problem is "rampant" they chortle!

Well, we need some adult perspective here. If we eliminate the thousands of independent RIAs like myself, the top 16 broker-dealers have about 90,000 investment advisers working for them. Even if all of the regulatory actions were against individual advisers (some of the more serious were against their firms), that's a rate of just over one-tenth of one percent. To be more clear, that means out of every thousand advisers, one is a crook. "Gary, are you crazy? Defending your detestable competitors in the brokerage community?" No, I'm just trying to temper journalistic sensationalism. I mean, suppose in 2011 two of every thousand brokers were crooks. Oh no! Doubled again! Form another Federal agency!

All kidding aside, there are still serious concerns:

The State of Oregon has some great guidelines here for avoiding victimization by nefarious schemers here:

Avoid Investment Fraud and Abuse In addition, you can subscribe to their Consumer Alerts. I think their most important bit of advice is don't be embarrassed to report getting ripped off. You may help save someone else's life savings and/or recover your own. Most of us are no match for a skilled con artist.

Of course, it's best to avoid getting ripped off altogether by dealing only with independent Registered Investment Advisers who are legally required to put your interests first.

Like me.

In a hissy fit of exaggeration, though, AdvisorOne passes along the inane idea that there is a "nationwide surge" in investment fraud, citing 1,241 regulatory actions in 2010 "more than double the 506 cases in 2009". The problem is "rampant" they chortle!

Well, we need some adult perspective here. If we eliminate the thousands of independent RIAs like myself, the top 16 broker-dealers have about 90,000 investment advisers working for them. Even if all of the regulatory actions were against individual advisers (some of the more serious were against their firms), that's a rate of just over one-tenth of one percent. To be more clear, that means out of every thousand advisers, one is a crook. "Gary, are you crazy? Defending your detestable competitors in the brokerage community?" No, I'm just trying to temper journalistic sensationalism. I mean, suppose in 2011 two of every thousand brokers were crooks. Oh no! Doubled again! Form another Federal agency!

All kidding aside, there are still serious concerns:

- Those are just the ones who got caught

- Breaking the law

- And didn't quickly make things right to avoid regulatory action

- The law still does not hold Wall Street to a fiduciary standard, remember? Astoundingly, it is still legal for them to put their interests before yours. So even though brokers have a fiduciary relationship with their clients (click on that link to see the definitions of "fiduciary") they do not have a fiduciary obligation. It is unbelievable what it is still legal to inflict on the public.

The State of Oregon has some great guidelines here for avoiding victimization by nefarious schemers here:

Avoid Investment Fraud and Abuse In addition, you can subscribe to their Consumer Alerts. I think their most important bit of advice is don't be embarrassed to report getting ripped off. You may help save someone else's life savings and/or recover your own. Most of us are no match for a skilled con artist.

Of course, it's best to avoid getting ripped off altogether by dealing only with independent Registered Investment Advisers who are legally required to put your interests first.

Like me.

Subscribe to:

Posts (Atom)