As David Lenok points out in his excellent article, [1] the fact that crypto is called a “currency” confuses people. Normally, if you take cash out of your savings account that isn’t a taxable event. However, crypto currencies like Bitcoin and Ether are not considered currencies by IRS. They are in effect commodities and subject to the same taxation as commodities: long and short term capital gains.

Let’s say you bought one Bitcoin for $333 in 2015. As of March 29 that one Bitcoin is worth $57,456. So you decide to buy a Tesla Performance Model Y for $62,000, kicking in the extra $4500 from savings. What a deal! A Model Y for $333! But wait, is that what this transaction is really going to cost you?

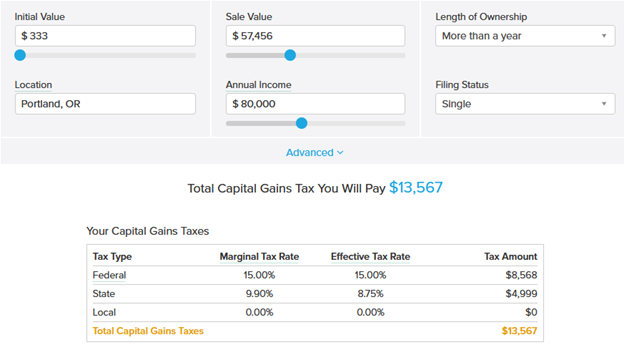

No. By spending that Bitcoin you will trigger capital gains taxes on $57,123, the current value minus your purchase price of $333 in 2015.

Uh oh.

Your normal taxable income is around $80,000. So, with that additional $57,123 you’re solidly in the 15% Federal cap gain bracket and 9.9% Oregon income tax bracket. And it gets better. Because your Schedule A deductions- including the Oregon capital gains tax (which is the same as income tax rates) can’t be deducted from Federal taxable income You’ll owe 15% on the whole $57,123 or $8568. Then, kick in Oregon tax of $4999 for a total of $13,567 extra you’ll need to pay after you get a courteous letter from IRS in 6 months.

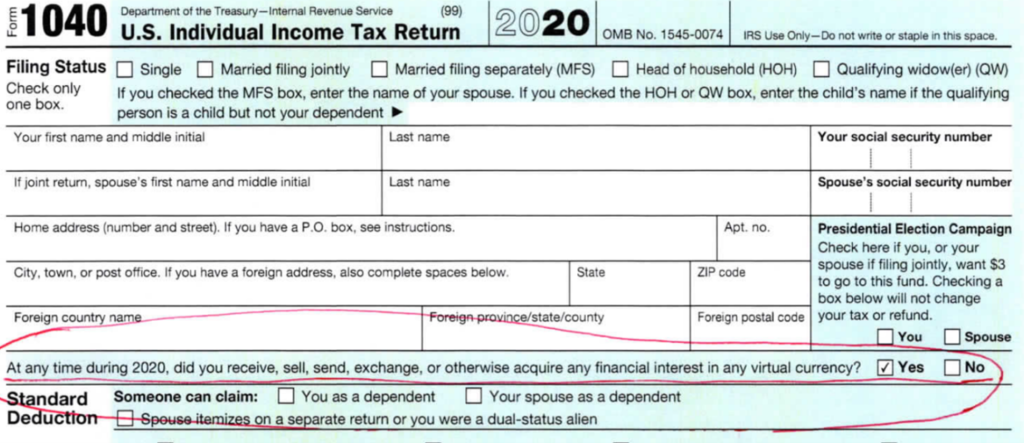

How will the IRS know? Well, take a look at the latest 1040. Do you dare lie to IRS? I wouldn’t. That counts as perjury.

Still, what a deal to get a Model Y, without doing any work, for less than $5000 out of pocket!

Have any questions? Let me know!

- Gary

No comments:

Post a Comment

Your Constructive Comments Are Welcome!